Why Depreciation Matters for Columbus Landlords

Why Depreciation Matters for Columbus Landlords

Many landlords view depreciation as merely a line on a tax return. However, in reality, it’s one of the most powerful and underutilized tools for long-term rental property planning. Depreciation doesn’t just reduce your taxable income; it helps you forecast when your property will need major repairs or replacements, from roofs to furnaces. When you understand it, you can plan capital expenses before they become financial emergencies.

Here in Columbus, that kind of forward thinking matters. The city’s rental market remains one of the most stable in the Midwest, thanks to steady job growth, strong demand from young professionals, and relatively affordable housing costs. As of late 2024, local rental vacancy rates hovered below 6%, a sign that well-maintained properties continue to attract reliable tenants year-round.

For landlords, that stability creates both opportunity and responsibility. Older homes in Franklin County, many built between the 1960s and 1990s, are now reaching the stage where mechanical systems, roofs, and plumbing need proactive replacement. By tracking depreciation schedules, investors can align their maintenance reserves with real-life property lifecycles, ensuring that funds are available when big-ticket items come due.

Depreciation isn’t just about accounting; it’s about strategy. Understanding how depreciation fits into your financial planning means fewer surprises, stronger cash flow, and a more resilient portfolio in a competitive market like Columbus.

How Depreciation Affects Your Cash Flow and ROI

The Cash Flow Advantage

One of the biggest benefits of depreciation is its impact on cash flow, something every landlord cares about. Depreciation allows you to reduce your taxable income without reducing your actual income. In other words, it doesn’t change what you collect in rent or what you spend on maintenance; it simply lowers the amount the IRS considers “profit.”

Because depreciation is a non-cash expense, you can claim it each year while keeping every dollar of your rental income in hand. For landlords in Columbus and throughout Ohio, this can mean thousands in annual savings that can be reinvested into your property or used to offset maintenance costs. The result? Better liquidity and stronger long-term returns.

Real Example (Columbus-Based)

Let’s look at how this plays out in real numbers.

Imagine a Columbus landlord renting a single-family home for $1,500 per month. That’s $18,000 in gross annual rent. Subtract roughly $5,000 for expenses like insurance, repairs, and property management, and your net income before depreciation is $13,000.

Now, let’s apply depreciation. If your building’s depreciable basis is $200,000, you can deduct about $7,272 per year (based on a 27.5-year schedule). That drops your taxable income to around $5,700, cutting your taxable profit by more than half.

That’s real cash flow staying in your pocket, not the government’s.

The ROI Connection

Depreciation doesn’t just reduce taxes, it boosts your return on investment (ROI). By lowering your tax liability while maintaining net operating income (NOI), you effectively increase your post-tax yield. Over time, these annual savings can be set aside as capital reserves or rolled into new acquisitions, helping you scale your portfolio without additional out-of-pocket capital.

At RL Property Management, our owner portal makes this process simple. You’ll find detailed income statements, expense reports, and data that align perfectly with your CPA’s depreciation schedules, keeping your books organized and your strategy focused.

Common Depreciation Mistakes (and How to Avoid Them)

Depreciation can save landlords thousands of dollars each year, but only when it’s applied correctly. Even experienced investors make simple errors that can lead to missed deductions, IRS headaches, or inflated tax bills. Here are four of the most common depreciation mistakes Columbus landlords should avoid.

1. Delaying Depreciation Start Dates

Timing matters. Many landlords mistakenly wait to start depreciation until a tenant moves in, when in fact it should begin the moment the property is available for rent. That includes the period between listing and lease signing, any time the property could legally be rented. Missing this window can cost months of potential deductions, especially during turnover or renovation cycles.

(Source: IRS Publication 527, 2024 – “Placed in Service” definition)

Tip: Work with your CPA to confirm your “placed-in-service” date immediately after the property becomes rent-ready.

2. Mixing Up Repairs and Capital Improvements

It’s one of the most common points of confusion in real estate accounting.

Repairs maintain the property’s current condition, like fixing a leaky pipe or patching drywall, and are fully deductible in the year incurred.

Capital improvements, on the other hand, extend the asset’s useful life or increase its value, like installing a new HVAC system or remodeling a bathroom, and must be depreciated over time.

Example: Replacing a broken faucet = repair. Upgrading to a modern sink and countertop = capital improvement.

3. Not Updating After Major Renovations

Any time you replace big systems, like a roof, furnace, or plumbing, it changes your property’s depreciable value. A Columbus investor who recently upgraded both their HVAC and roof discovered that by reclassifying those improvements, their accountant was able to extend depreciation schedules and reduce audit exposure. Always notify your tax professional after substantial upgrades.

4. Poor Recordkeeping

Depreciation is documentation-driven. Without clear records, your deductions can be disallowed during an IRS review.

Pro Tip: Keep digital copies of every invoice, estimate, and warranty. RL Property Management’s owner portal automatically stores this information, giving landlords organized access to receipts for both repairs and capital projects.

Planning for Depreciation Recapture and Capital Expenses

Depreciation delivers major tax advantages while you own a property, but when you sell, the IRS expects to “recapture” some of that benefit. For landlords planning long-term, understanding this concept (and planning for it early) can prevent an unpleasant surprise at tax time.

Understanding Depreciation Recapture

Depreciation recapture is the IRS’s way of reclaiming some of the tax savings you’ve received over the years. When you sell a rental property for more than its depreciated value, the total gain includes both appreciation and the portion previously written off through depreciation. That depreciation portion is taxed, often at up to 25% federally, even if your overall capital gains rate is lower.

This process frequently catches landlords off guard, especially those who’ve held their properties for a decade or longer. The longer you own (and the more you’ve depreciated), the more important it becomes to plan your exit strategy thoughtfully.

Quotable line: “Recapture is inevitable, but surprises are optional.”

Example Scenario

Imagine you purchased a Columbus rental home for $250,000 and claimed $50,000 in depreciation over seven years. If you later sell that property for $300,000, the $50,000 of prior depreciation is subject to federal recapture tax, about $12,500 in this case. That’s in addition to any capital gains tax owed on your net appreciation.

Without preparation, those taxes can consume a significant portion of your profits at closing.

How to Offset the Impact

One of the most effective strategies is a 1031 Exchange, which allows investors to roll their proceeds into a new investment property and defer capital gains and recapture taxes until a future sale.

Alternatively, some landlords reinvest their depreciation savings into capital improvements, upgrades that extend property life, increase tenant appeal, and restart new depreciation schedules for those improvements. This not only preserves tax efficiency but also boosts long-term value.

Local Market Tie-In

In the Columbus market, where home values consistently rise year-over-year, appreciation often compounds the impact of recapture taxes. A well-timed renovation, refinance, or exchange can help you stay ahead of those tax consequences while keeping your portfolio growing.

Investor Checklist

✅ Track annual depreciation amounts accurately.

✅ Record every capital improvement with its cost, date, and purpose.

✅ Review depreciation schedules annually with your CPA.

✅ Consult your accountant or property manager before selling or refinancing to minimize recapture exposure.

Using Depreciation for Smarter Capital Planning

Depreciation isn’t just an accounting concept; it’s a strategic forecasting tool that helps landlords prepare for the inevitable lifecycle of their properties. By aligning depreciation schedules with your capital planning, you can turn predictable wear and tear into a data-driven maintenance strategy that safeguards both cash flow and property value.

Depreciation as a Forecasting Tool

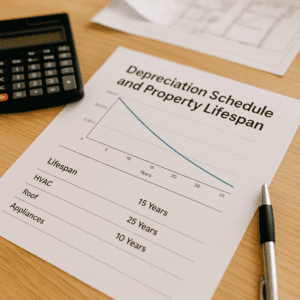

Every major system in a rental property has a useful life. Depreciation schedules help investors anticipate when key components, like HVAC systems, roofs, and water heaters, will likely need replacement. Instead of being caught off guard by an emergency expense, you can use those schedules to plan.

For example, a water heater typically depreciates over about 10 years. If your accountant tracks that schedule, you can begin setting aside funds by year seven or eight to prepare for replacement. The same principle applies to appliances, flooring, and other building systems. When you treat depreciation as a planning tool, every deduction today becomes a roadmap for tomorrow’s repairs.

Building Capital Reserves

At RL Property Management, we recommend maintaining around a $500 per unit maintenance reserve, a standard many Columbus landlords now follow to avoid financial stress when big repairs hit. These reserves, paired with accurate depreciation tracking, create a proactive buffer for replacements and renovations.

By matching your reserve strategy to your depreciation schedule, you’re effectively funding future upgrades with your own foresight. This approach prevents last-minute borrowing and protects monthly cash flow, even when high-cost items like roofs or HVAC systems need attention.

Local Example: Real-World Timelines

Across Columbus, rental properties tend to follow consistent life cycles:

- HVAC systems: 12–15 years before major repair or replacement

- Roofs: 20–25 years, depending on materials and weather exposure

- Appliances: 5–10 years, depending on usage and brand

(Source: InterNACHI Life Expectancy Chart, 2024; National Association of Home Builders)

These lifespans often mirror the IRS’s depreciation schedules, meaning you can synchronize maintenance planning with tax efficiency.

Aligning Depreciation with Long-Term Growth

Smart investors don’t view depreciation as “lost value”; they see it as a signal to reinvest. Using depreciation insights, landlords can plan upgrades that not only extend the property’s life but also boost tenant satisfaction, reduce turnover, and increase rental income.

When to Bring in the Experts

When DIY Accounting Isn’t Enough

For new landlords, tracking a single property’s depreciation might seem manageable. But as your portfolio grows, so does the complexity. Each property may have its own depreciation timeline, capital improvements, and mid-year adjustments. Without accurate tracking, it’s easy to overstate expenses or miss deductions entirely.

Professional accountants don’t just ensure IRS compliance; they also help you maximize long-term savings through proper asset classification and depreciation planning. A qualified CPA can identify opportunities like cost segregation studies or 1031 exchange strategies that individual investors might overlook.

Accurate depreciation isn’t about bookkeeping; it’s about protecting your financial foundation.

How Property Managers Support Financial Planning

Even with a great accountant, landlords benefit from a property management team that provides clean, consistent financial data. RL Property Management simplifies this process through transparent monthly statements, maintenance forecasting, and an online owner portal that organizes invoices, expense reports, and profit-and-loss statements.

Because RLPM operates locally, our team understands Columbus market trends, average system lifespans, and what types of upgrades deliver the most long-term value. That context helps owners prioritize improvements that enhance both tenant experience and future ROI.

Partnering for Strategy, Not Just Service

The most successful investors don’t just hire accountants or property managers to manage tasks; they hire partners to manage strategy. Together, your CPA and property manager can help you time renovations, plan for recapture events, and allocate reserves in a way that supports sustainable growth.

When you surround yourself with experts who understand both the numbers and the market, depreciation stops being complicated and starts becoming a competitive advantage.

Build Long-Term Wealth, Not Short-Term Headaches

Depreciation is more than a line on your tax return; it’s a long-term wealth-building tool. When used strategically, it helps landlords understand their property’s true lifecycle, anticipate costs, and reinvest at the right time. Rather than reacting to maintenance surprises, proactive investors in Columbus’s stable rental market use depreciation to extend property life, preserve cash flow, and grow equity year after year.

By tracking depreciation alongside capital improvements, you gain visibility into your property’s performance beyond the balance sheet. Each year of deductions can inform when to upgrade systems, renovate units, or plan your next acquisition, all while keeping more money in your pocket.

Successful landlords treat depreciation as part of their overall asset management strategy, not just a tax benefit. It’s how they turn today’s paper deductions into tomorrow’s real growth.

When you understand depreciation, you stop chasing tax savings and start building long-term wealth.

Want help forecasting expenses and maximizing your long-term returns?

Schedule a consultation with RL Property Management to see how our proactive planning tools and financial insights can protect and strengthen your Columbus investment portfolio.